You were coming back from your office after having a cheerful day. But then you see a message that is “QuickBooks Error PS032” on your device. That arises when you are not able to download payroll updates. This is when you start getting frustrated. Because you might lose your company data and not be able to finish the work on time.

Well, don’t stress as we will help you to fix QuickBooks error code PS032 with the best solutions. So, we think without wasting any time we should get into it.

What is QuickBooks Error PS032?

QuickBooks Error PS032 prevails when you are trying to download payroll updates and this happens because of wrong data input or settings of software that are not done correctly.

It will throw a message stating “QuickBooks having trouble installing payroll tax table updates”.

Symptoms of QuickBooks PS032

Below is the list of symptoms that will help you to identify this error easily:-

- Not able to download the payroll updates.

- When the tax table fails to update or may get stuck in the process.

- When you receive an error message on your screen.

- If your system starts freezing up then it is an indication of a payroll error.

Causes of QuickBooks Error PS032

- When the tax table file is damaged or corrupted.

- When the company file of QuickBooks is damaged or corrupted.

- If the billing information is wrong or out of date.

- When QuickBooks fails to read the information registered for software.

- If the QuickBooks payroll or its components may damage tax table files.

- If you have not registered QuickBooks applications.

Also Read : Troubleshoot QuickBooks Script Error- 8 Easy Methods

Points to remember:-

- Firstly, you have to validate the QuickBooks payroll subscription.

- You must have to update the QuickBooks Desktop with the latest released version.

- Make sure to take all the backups of the QuickBooks company file.

- Check whether the billing information entered in the payroll account is right or not.

- Make sure you have only one QuickBooks software on your system.

How to Resolve QuickBooks Error PS032?

Below are some methods to resolve the PS032 QuickBooks payroll error. Follow all the steps correctly:-

Method 1- Repair QuickBooks Software

- Initially, you have to close your QuickBooks Account.

- Then, close all the other system windows, and make sure that all the other windows are also closed.

- Now, open the Windows task manager and check all the windows of QuickBooks.

- After that, again open QuickBooks to download payroll updates.

- Lastly, if you still face any issues then move to the file and click on the Utilities and Repair QuickBooks.

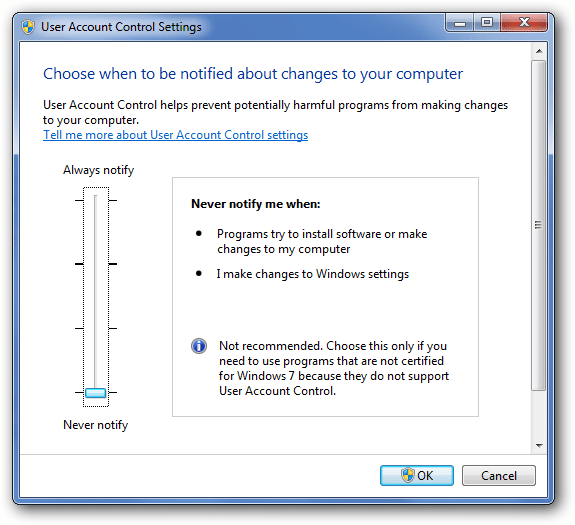

Method 2- Turn Off User Account Control

- Firstly, log in to your Intuit account and check your QuickBooks license, verifying if you have the latest version of QuickBooks.

- Check all the details like billing information and the date of QuickBooks payroll service account information.

- Now, refer to the QuickBooks error technical support team to resolve.

- After that, move to the file > Utilities and then click on verify and create QuickBooks data.

- Lastly, if you are using Microsoft Windows 7 or 8, then you have to switch off User account control (UAC). and download QuickBooks payroll updates.

Conditions 1- If only One Version of QuickBooks Desktop is Installed

Don’t follow these steps if you have only one version of QuickBooks Desktop.

- Take all the backup of QuickBooks company files.

- Then close all the other applications.

- Now, open the Run Windows.

For Windows 8:

- Firstly, go to the Window System sections.

- Then open the start tab.

- Now, you have to click on the background for all applications.

- Click on the Run options.

For Windows 7 and XP:

- First of all, click on the Start, if you are not logged in as admin.

- Now, go to the All program and then click on Accessories.

- Lastly, click on the Run.

For Windows Vista:

To open the Run box then click on the vista logo and then press and hold Windows +R keys:-

- Firstly, open the Control Panel.

- Then, go to the Program and features and then double-click on them again to add or remove the programs in windows vista.

- Now, the only one version user doesn’t need to continue the steps.

- The above steps will open the QuickBooks desktop installation wizard.

- Then, tap on the Next key.

- After that, choose to remove and tap on next. As per requirements, continue with the process.

- To complete the update, the error message must have a to-go option. And to retrieve the update, click on the yes and go online.

- The error may have the option to tap on OK to go online. Click on the Ok button and run the installation automatically. You may receive an error message again.

- Now, it is recommended to close QuickBooks, if the data file is on the server. Also, run the payroll update from the server and if you succeed on it then install it on all other versions of QuickBooks.

Condition 2- If you have Multiple Version of QuickBooks

Initially, you have to install a clean version of the QuickBooks desktop to do well in selective startup.

- For multiple versions of QuickBooks Desktop.

- Clean all the additional installations.

- Reset QuickBooks update.

- Now, you have to download the latest version of the payroll tax table.

- After that, resort to the lists and then use the verified data/ rebuilt data.

- Lastly, select clean uninstall/re-install in selective startup.

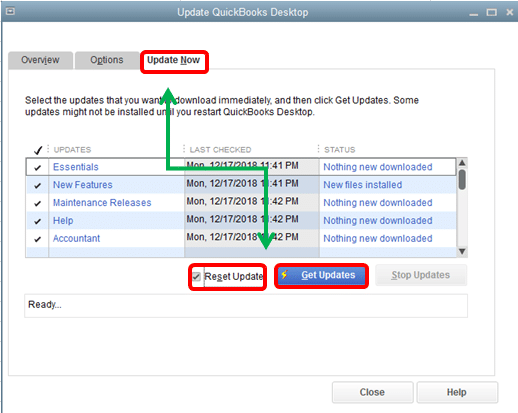

Method 3- Download the QuickBooks and Payroll Tax Table Latest Version

- Firstly, you have to remove the existing and the additional installations.

- Then, move to the help menu and select update QuickBooks.

- Now, reset the QuickBooks updates.

- Download the latest payroll tax table along with that.

- After that, re-sort the list of users of the verified data.

- Then, perform the clean uninstall in the selective start-up.

- Finally, update the tax table.

Method 4- Note the Billing Information

- Firstly, click on the F2 key.

- Then, keep a note of your QuickBooks license number.

- Now, close the product information window, by clicking on the OK tab.

Method 5- Rename the CPS folder

- Initially, press and hold the Windows+E key to open the file explorer.

- Then, select the Options tab.

- Go to the local disk C.

- Now, if you are not able to find the program file then open the program file folder.

- Then, you have to open the QuickBooks desktop folder that resembles the version of your system.

- After that, open the components and move them to the payroll folder.

- Now, click on the CPS folder and tap on rename options.

- You have to rename it and type CPSOLD and tap enter.

- Then, make a new CPS folder and again open QuickBooks desktop.

- Lastly, download the latest version of the payroll tax table update.

Also Read : QuickBooks Error PS036 in Detailed

Wrapping Up!

In the above article, we discussed some steps to resolve QuickBooks Error PS032. We have also provided all the simple methods that will be helpful for you to fix the PS032 Error. If you ever have any other issues or errors, you can check out our other posts and let us know in the comment section below.

Frequently Asked Questions (FAQs)

Q1. How do I fix QuickBooks payroll errors?

- Turn Off UAC.

- Change the name of the CPS folder.

- Use Repair to fix QBs payroll error.

- Stop all QuickBooks processes.

Q2. How do I do a payroll correction in QuickBooks online?

- Go to your Home Page and select Pay Liabilities.

- Now, navigate to the payment check under the Payment History section.

- Click on the Delete button and press OK.

Q3. Can you edit an existing paycheck in QuickBooks Desktop?

Yes, you can only if the status is not yet changed.

Q4. How do I undo payroll in QuickBooks Desktop?

- Go to Employees and choose the Paycheque list from Run Payroll.

- Then select the cheques you want to delete.

- Tap on Delete and click on Yes or No.